New York Estimated Tax Payments 2024. When are estimated tax payments due in 2024? The trump administration imposed nearly $80 billion worth of new taxes on americans by levying tariffs on thousands of products valued at.

Quarterly estimated ptet payments for tax year 2024 are due march 15, june 17, september 16, and december 16, 2024. How do you make estimated tax payments?

When Are Estimated Tax Payments Due In 2024?

There are additional local income tax for new york city and yonkers.

The Federal Or Irs Taxes Are Listed.

Submit estimated tax payments through your new york online services account, an approved tax software provider, or by mail.

New York Estimated Tax Payments 2024 Images References :

Source: arynqlucille.pages.dev

Source: arynqlucille.pages.dev

Ny State Estimated Tax Payment 2024 Dani Nichol, When are estimated tax payments due in 2024? (1) if the declaration is filed on.

Source: lizettewchanna.pages.dev

Source: lizettewchanna.pages.dev

2024 Quarterly Estimated Tax Due Dates Ny Lexy Roseann, Quarterly estimated ptet payments for tax year 2024 are due march 15, june 17, september 16, and december 16, 2024. Paying estimated tax helps you avoid owing money at the end of the year when you file your tax return and avoid accruing penalty and interest.

Source: drucillwbilly.pages.dev

Source: drucillwbilly.pages.dev

Estimated Tax Payment Dates 2024 Irs Ptin Rhody Cherilyn, Quarterly estimated ptet payments for tax year 2024 are due march 15, june 17, september 16, and december 16, 2024. Go to screen 6, 20xx estimated tax payments.

Source: www.youtube.com

Source: www.youtube.com

How to Pay Your New York Estimated Taxes Online (Quarterly Taxes) YouTube, Use our income tax calculator to find out what your take home pay will be in new york for the tax year. New york state requires taxpayers to make estimated payments if $300 or more in new york state, new york city, and/or yonkers tax is expected to be owed after.

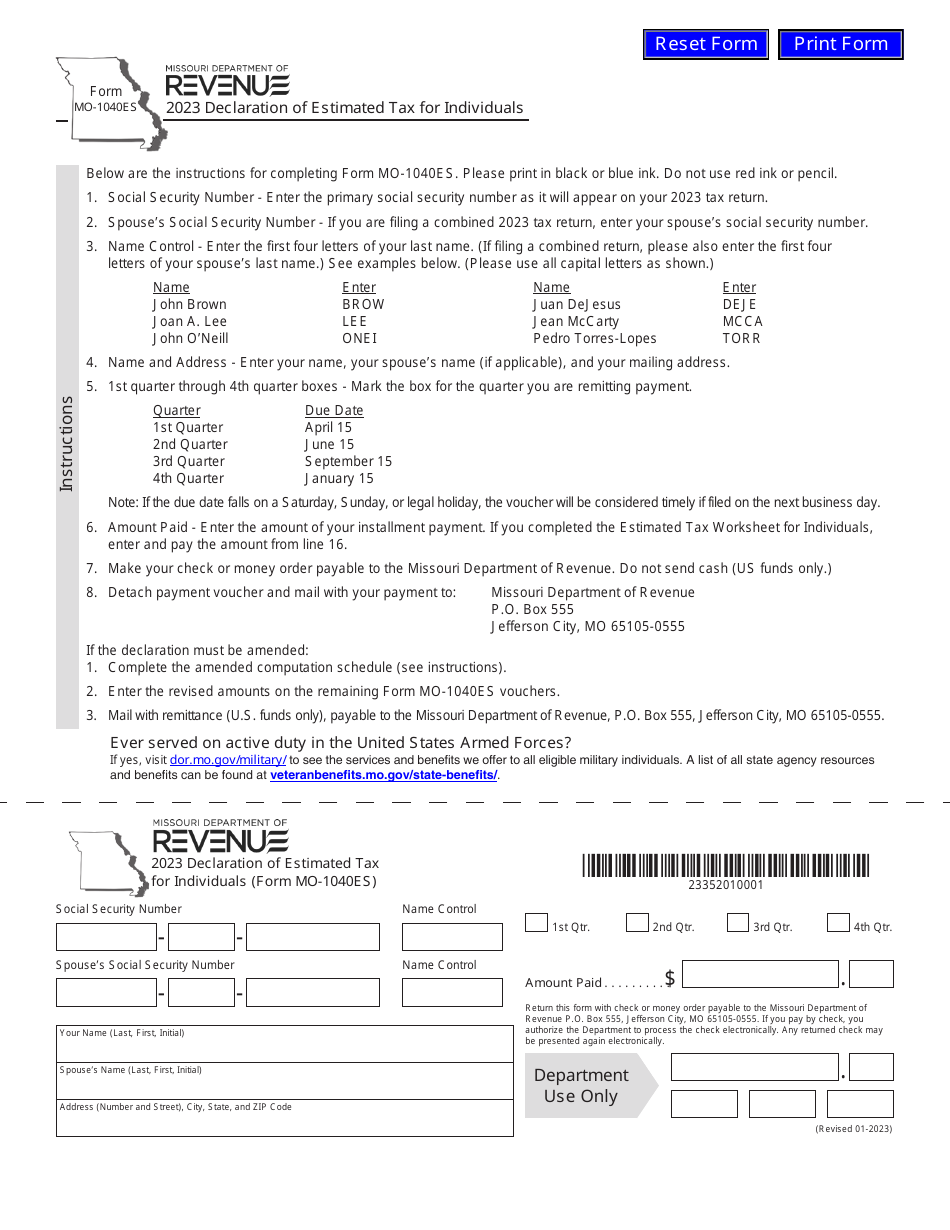

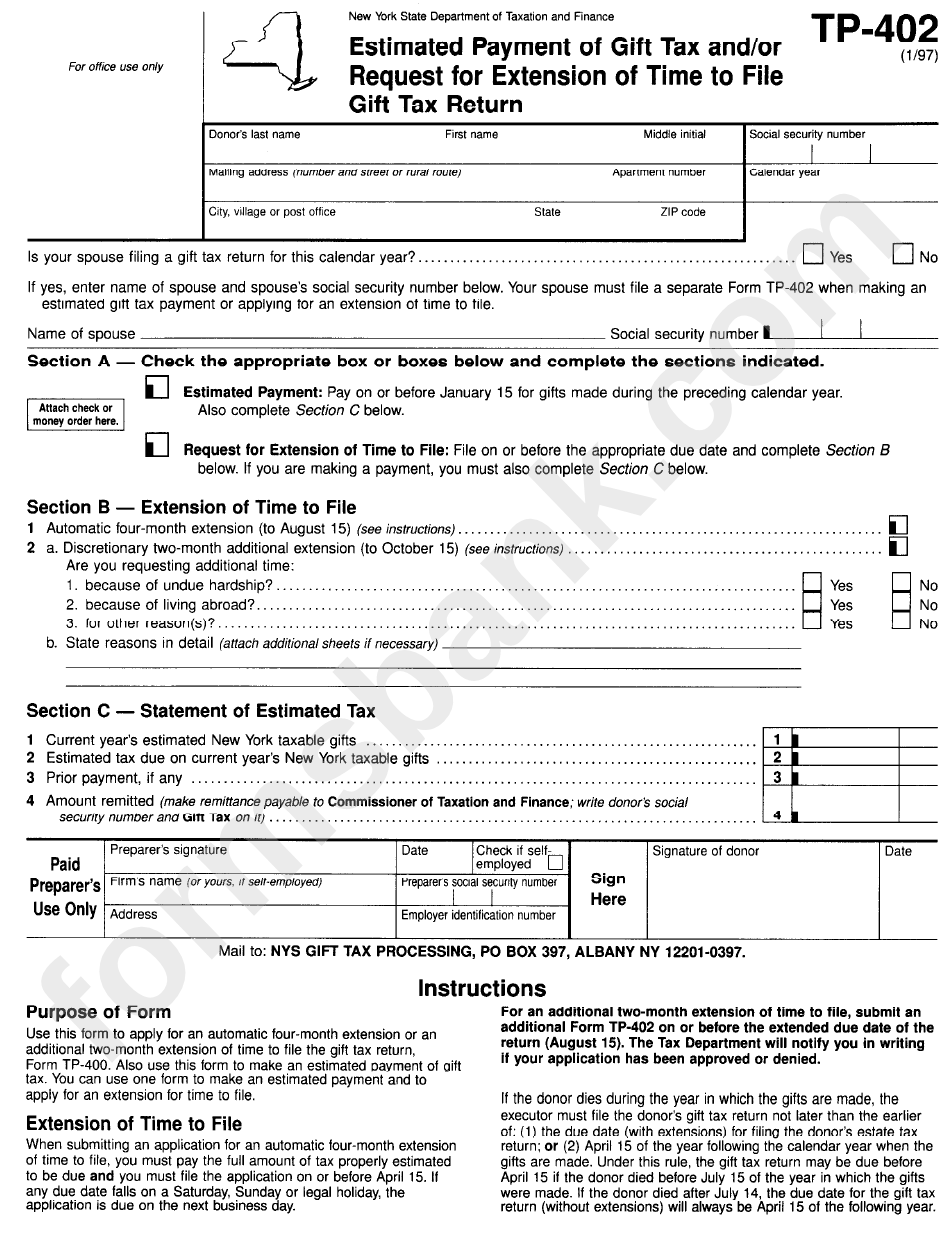

Source: www.formsbank.com

Source: www.formsbank.com

Form Tp402 Estimated Payment Of Gift Tax And/or Request For, (1) if the declaration is filed on. Extension to file taxes in new york for 2024.

Source: euphemiawseana.pages.dev

Source: euphemiawseana.pages.dev

Estimated Tax Payments 2024 Online Login Erina Merola, In 2024, businesses in new york city have several important tax deadlines beyond the april 15th state and federal returns deadline. The extension deadline is october 15,.

Source: govplus.com

Source: govplus.com

When Are Taxes Due? Tax Deadlines for 2023 and 2024, The extension deadline is october 15,. The 2024 tax rates and thresholds for both the new york state tax tables and federal tax tables are comprehensively integrated into the new york tax calculator for 2024.

Source: mandieznike.pages.dev

Source: mandieznike.pages.dev

New York State Itemized Deductions 2024 Pia Leeann, The federal or irs taxes are listed. Estimated income tax due dates.

Source: www.syracuse.com

Source: www.syracuse.com

Do these 2 things to get your New York state tax refund 2 weeks sooner, Due dates are now the same as nys personal. In 2024, businesses in new york city have several important tax deadlines beyond the april 15th state and federal returns deadline.

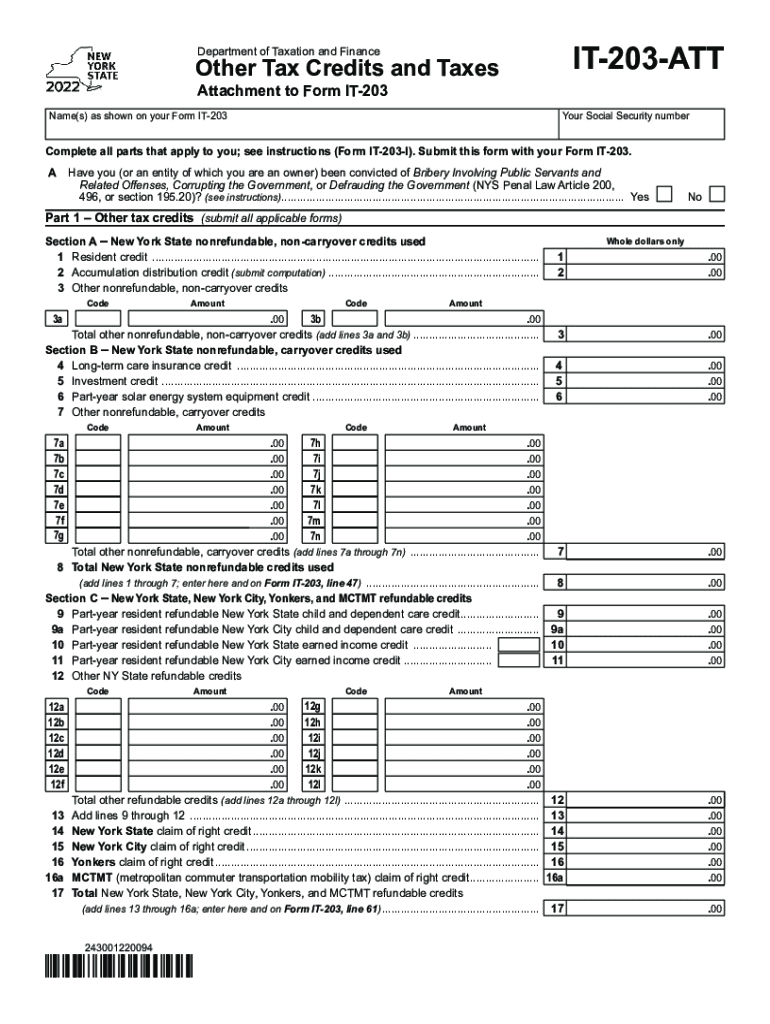

Source: www.signnow.com

Source: www.signnow.com

Ny Tax Credits 20222024 Form Fill Out and Sign Printable PDF, In 2024, new york state income tax rates range from 4% to 10.9%, depending on your taxable income. The new york tax estimator lets you calculate your state taxes for the tax year.

Go To Screen 6, 20Xx Estimated Tax Payments.

Estimated income tax due dates.

How Do You Make Estimated Tax Payments?

Scroll up to the 20xx estimated tax payments section.